Office Address

Ist Floor, 38 N, Shree Balaji Tower Hisar

Phone Number

+91 98965-80000

Ist Floor, 38 N, Shree Balaji Tower Hisar

+91 98965-80000

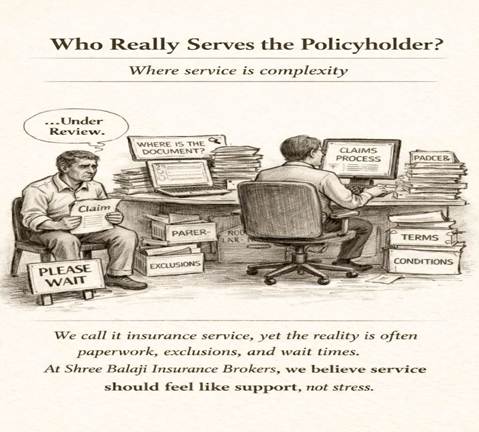

Insurance is built on a simple promise protection when it matters most. For a policyholder, insurance represents security and support during uncertain times. However, the real experience of insurance often begins not with protection but with forms, procedures and fine print. Understanding policyholder support is essential for success because the way insurance is delivered matters just as much as the policy itself.

Insurance is meant to be a service driven industry. Yet, In reality, many policyholders find themselves navigating complex processes, repeating the same information and waiting for updates during already stressful situations. Policies are designed for safety but processes are designed for control. Somewhere between these two stands the policyholder, trying to understand clauses, exclusions and timelines.

Table of contents [Show]

To understand why policyholder support is important. It helps to look at how insurance functions beyond the policy document. Insurance is not just a financial service. It is a long term relationship that should prioritize clarity, guidance and accountability.

Aspect

| Traditional Insurance Experience

| Policyholder Centric Approach

|

Communication

| Technical language and limited explanations

| Clear, simple and proactive guidance

|

Claim Process

| Document heavy and time consuming

| Assisted, transparent and well tracked

|

Customer Role

| Treated as a case number

| Treated as an individual with unique needs

|

Support

| Reactive and process-driven

| Human, accountable and supportive

|

Outcome

| Confusion and frustration

| Trust and long term confidence

|

When procedures outweigh people, service becomes mechanical. The irony is not in intention most insurers genuinely want to help but in execution.

Policyholders often approach insurance during moments of uncertainty, loss or financial stress. In these moments, they do not need a system. They need someone who understands the system on their behalf. Understanding policyholder support ensures that insurance fulfills its true purpose.

At Shree Balaji Insurance , the belief has always been that insurance should feel less like a transaction and more like genuine support. The role is not limited to selling insurance policies but extends to standing between complexity and clarity.

By helping policyholders understand their insurance before challenges arise and staying involved when they do. Shree Balaji Insurance ensures that people are never left alone with confusing procedures. This human first approach transforms insurance from a technical obligation into a dependable safety net.

Understanding policyholder support is essential for success because insurance is ultimately about people not paperwork. While policies provide financial protection, service provides peace of mind. True insurance success lies in better interpretation, better guidance and better ownership.

For every policyholder, insurance should be a source of confidence, not confusion. And for providers like Shree Balaji Insurance, quiet, accountable and human service is what defines real value in the insurance journey.